Initial research revealed a gap between Payless’ aggressive launch activities and how clearly the brand was understood. While communication heavily targeted the youths, there was limited clarity around what the brand stood for and more importantly, what it actually offers. Payless was visible, but not yet clearly positioned.

Background

Payless, also known as Payless Africa, is a fintech platform that launched in Kenya in May 2024. It entered the market with a focus on providing mobile-first digital financial services to the Kenyan youth population, who are underserved and unbanked.

The platform was built around the idea of simplifying everyday payments while reducing the financial friction associated with transaction fees and hidden charges. One of Payless’ key differentiators at launch was its lower transaction costs, at times up to 60% cheaper than those of established players, as well as free transaction allowances up to a daily threshold. These benefits and more were designed to remove cost barriers and encourage trial among price-sensitive users.

Diagnosis

Initial research revealed a gap between Payless’ aggressive launch activities and how clearly the brand was understood. While communication heavily targeted the youths, there was limited clarity around what the brand stood for and more importantly, what it actually offers. Payless was visible, but not yet clearly positioned.

So, from the onset, it became clear that the brand needed a unifying message, one that immediately associates Payless with payments and financial simplicity.

Business Problem

Payless uptake has been on a slow trajectory among the youths since launch, viewing it as another digital platform that will come and fade away.

Consumer Problem

Youths are feeling the financial pressure more than ever due to the rising cost of living as opportunities become harder to come by. Transaction fees, hidden charges and inefficient payment systems are among the strains they’re facing, turning even basic money transfers into a recurring pain point.

Brief

Establish a clear understanding of who Payless is in the market by developing an integrated brand campaign that positions Payless as a brand that understands the youth, a brand that is for the youth and a brand that offers practical financial solutions that are affordable, transparent and accommodating.

Target Audience

Kenyan youth.

It is said that the current population of youth is believed to be the most important generation in the country because they’re widely regarded as resilient, informed and digitally savvy. However, despite their educational qualifications, capabilities and ambitions, many face limited access to employment and economic opportunities. As a result, they are often forced to rely on family support or take up whatever jobs they can find.

They feel abandoned by a system that promised opportunities but isn’t delivering. And in the wake of the Gen Z protest in July 2024 proved that this is a group of people who have had enough.

- Key Challenges Facing Youth

- – Feeling ignored by ‘people at the top.’

– Limited access to opportunities & employment, especially for those aged 20 – 24 years

– The rising cost of living has affected youth more than any other age group

– Health and other related social issues

– A general sense that their struggles are not understood

Solution

Show Payless as the brand that eases the financial pain associated with money transfers and payments by focusing on simplicity, affordability, and transparency of its offering, because Payless believes simplifying financial transactions is the beginning of living a more manageable life. And it is from this thinking that we arrived at this central narrative, that;

CREATIVE PLATFORM

This formed the basis of our campaign, drawn from a Swahili proverb: “Uchungu wa mwana aujuaye ni mzazi.”

CrEATIVE EXPRESSION

Painless Payments. Painless Living.

A succinct expression of what Payless does. Its short and rhythmic structure makes it more memorable, reinforcing Payless’ role at the intersection of payments and everyday living.

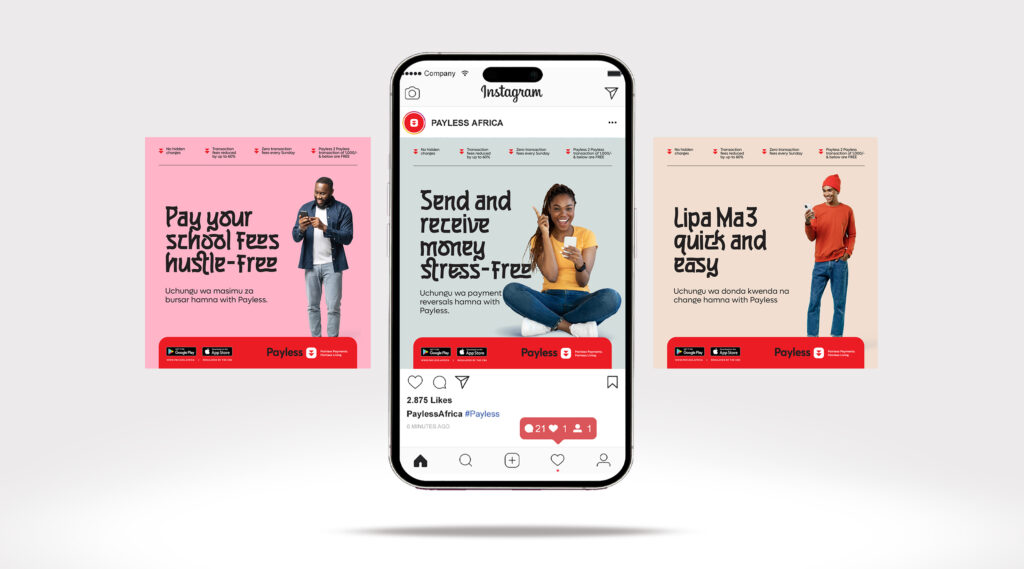

execution

We anchored the work in everyday cultural situations and the strains young people face daily, both in life in general and when making payments or transferring money. These familiar moments helped the campaign feel more relatable and distinctive, while creating room to extend the idea into other cultural situations relevant to Kenyans.

At its core, the message was: life should be enjoyed, not spent dealing with unnecessary hurdles.

co-creation

Using meme generators, youths can be part of the campaign as co-creators by inviting them to come up with funny and interesting campaign lines based on their painful experiences in life and in moments when dealing with money. The most voted lines will eventually be used in the next billboard campaign, with cash rewards and other consolation prizes going to the youths whose lines are voted as the best.

- Objectives:

- – Brand engagement

– Increase App downloads

– Increase brand talkability & shareability

– Build credibility